Dont Buy This Penny Stock Myth!

People are rather curious as to why Im focused on penny stocks. When I explain to friends, family, and new acquaintances exactly what I do

they all give me this strange look.

People are rather curious as to why Im focused on penny stocks. When I explain to friends, family, and new acquaintances exactly what I do

they all give me this strange look.

Penny stocks?

As if theyre some disease or something

I often find myself on the defensive initially in these conversations, especially when talking to other investment professionals. I tend to point out the positives of penny stocks that many folks simply arent aware of.

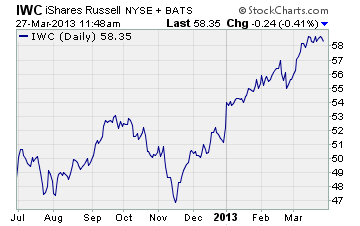

Recently, Ive been talking about how well penny stocks have performed as the major stock indexes have hit new highs. For proof, I like to pull out my iPhone and show them the chart for iShares Russell Microcap Index (IWC).

Of course, basic human nature makes people push me for more specifics.

Well, that just tracks a group of stocks Investing in individual penny stocks is super risky

And thats the myth Im hoping to bust here today- for you my readers.

You see, investing in individual penny stocks is no more risky than investing in mega cap stocks. Ultimately, it all comes down to the fundamentals of a company- and eventually the stock tells the tale with price direction.

Here are two stocks that tell this tale perfectly

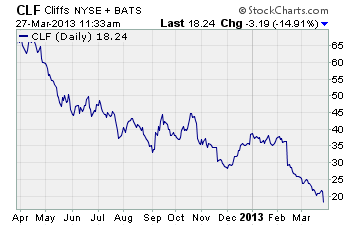

First, lets take a look at mega-cap iron ore producer, Cliffs Natural Resources (CLF). Cliffs has a massive $3.39 billion market cap and is one of the biggest iron ore players in the industry.

Id bet virtually every natural resource investor has held, or is buying, CLF at some point. In fact, the average ETF and mutual fund investor probably has a piece of this mega-resource company in one form or another.

Now unfortunately due to changes in the iron ore industry, the stock has simply tanked over the past year. Take a look for yourself-

Thats just horrible to see, especially since the major stock averages are toying with all-time highs. Instead, CLF investors have lost more than 66% over the past 12 months.

Here we have a natural resource company that produces real products- yet the stock has lost two-thirds its value after downgrades and changes in fundamentals.

Now, lets take a look at a stock 180 degrees from CLF

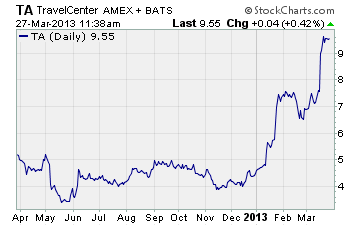

For this, Ive chosen TravelCenters (TA). TA has a market cap just over $280 million. And as a result of improvements in the US economy, the company has seen an increase in trucking traffic across the US.

For that reason, TA shares have simply soared

As you can see, shares are up more than 100% since the beginning of 2013!

And why? Its because the company has great fundamentals and huge upside potential regardless of if its a penny stock or not.

This is the bottom line

Dont buy into the myth that all penny stocks are risky business.

I just showed you that a stable, mega-cap stock has lost conservative investors a fortune- all while risky penny stock investors have done quite well with TA.

That alone should have you thinking twice about how you invest. As I say time after time, do your homework- and know what youre buying.

Until next time,

Brian Walker

Category: Investing in Penny Stocks, Penny Stock Tips