MSTG, BFLX, VGTL – Pump And Dump Alerts – March 16, 2012

This week were exposing these three popular Pump & Dumps: Mustang Alliances (MSTG), Bioflamex (BFLX), and VGTel (VGTL).

This week were exposing these three popular Pump & Dumps: Mustang Alliances (MSTG), Bioflamex (BFLX), and VGTel (VGTL).

That said, welcome to Pump and Dump Friday, where every week we highlight a few of the bogus promotions that are going on in penny stocks.

If you dont know how these schemes work, be sure to check out this free report that exposes the whole thing.

Now without further ado, here are this weeks disasters waiting to happen:

Mustang Alliances (MSTG)

For a second week in a row, were talking about Mustang Alliances. This week we have even more reasons to expose the pump and dump happening with MSTG.

Before we get into that, heres a quick recap if you missed last weeks write up

Mustang Alliances is yet another mineral exploration company hoping to find gold. Theyre planning to test drill at half a dozen mining concessions theyve purchased in Honduras. And like many of the companies we highlight, MSTG has sad financials

- $0 Revenue

- $620,562 loss for the first 9 months of 2011

- $62,206 in cash

Obviously, the financials alone are enough to avoid investing in the company. But the stock is also being manipulated in a pump and dump scheme. Since January 28th this year, hundreds of thousands of dollars have been paid to pumpers to hype shares of MSTG. Pumpers like Stock Castle, Wall Street Penny Stock Advisors, Stock Mister, Bull in Advantage, and of course, the latest Obscure Stocks (who was paid over $300,000 to promote these shares).

One of the problems I have with MSTG (outside of the pump and dump), is the press releases theyre putting out. Its as if theyre knowingly feeding the pumpers fodder to help them promote the stock. Take a look at one of the comments from their March 5th press release talking about their Bonanza Concession

The acquisition of potential nearby ounces coupled with an aggressive exploration program dovetails very well with our production plans for the Potosi ”

Lets break that down

The acquisition of potential nearby ounces Loose translation We have no clue if theres anything in the ground but were guessing there is and were going to let you think it too.

Could you imagine Apple coming out and announcing, Were excited to announce we have a new parts supplier for our new iPad 3. We think their parts will work well, so were pushing ahead with production.

You simply wouldnt hear that kind of talk from a major corporation! But somehow, a puny little gold exploration company can get away with that.

Better still coupled with an aggressive exploration program dovetails very well with our production plans

Wait, the exploration program dovetails well with production plans? Dont you have to have exploration complete prior to having production plans?

I mean, how do you know where to dig? How much to spend? What type of equipment will work best? How much it will cost to maintain?

Oh, wait, I almost forgot were talking about a pump and dump here. You dont need to know about those silly little details.

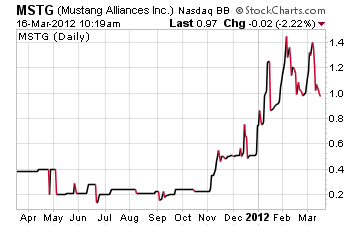

Moving back to the pump and dump scheme, lets take a look at the chart to see how things are progressing

Last week, MSTG was sitting up at $1.40 again. Apparently, the ride must be coming to an end as weve seen a double top already followed by a massive selloff.

Is that the 3rd party cashing out once again?

I warned you of this exact thing last week. And with MSTG still a dollar, you can still get out before this thing totally collapses and trust me, its headed there!

Bioflamex (BFLX)

Alright, Ive been waiting since Tuesday to get into BFLX. Now its time to expose Bioflamex for what it truly is a pump and dump!

If you missed my article Tuesday, I basically called out the CEO for complaining about his stock tanking in a single day. This guy basically blamed short sellers for smashing his companys shares from $.050 to $0.10 in a single day.

Of course, it had nothing to do with the over $500,000 in promotional fees paid to pumpers

The problem I pointed out is that short shares are on limited supply, at least at my broker. And I use Interactive Brokers, one of the largest in the business. If they have limited supply, then many brokers probably wont even have shares you can borrow to short. It doesnt add up.

For more details, you can read the article after youre done here. But youll want to stick around to learn more about the company itself first

For starters, BFLX has a jagged history. Before they became Bioflamex, the company was run as a mining exploration company. The name of the previous company was Deer Bay Resources, Inc, and was run by a different owner Gary Wong.

Thats an obvious leap for a company to make, gold exploration to fire extinguishers. Why didnt I think of that myself?

Id bet the new owners, Henrik Dahlerup and Kristian Schiorring, were just looking for a way to have a US-based company. You see, the company is registered in Nevada, but their headquarters are in Denmark!

While the business change last year is a red flag, the financials are even worse

From January 2011 until November 2011, BFLX pulled in $0 in revenue. But wait, dont they sell fire extinguishers?

Not yet

Theyve yet to produce a saleable product. In fact, theyve only now just entered into a production partnership with a mystery company.

Thats right in their press release, Bioflamex left out the name of their production partner. They simply said their new partner is a highly specialized European aerosol production company. I guess investors have no way of checking up on BFLX. So how do we know what theyre up to? Youll have to trust what theyre telling us in press releases. And that just doesnt cut it for me.

The only thing were left with is the financials so lets get back to them.

With $0 in revenue, BFLXs bottom line is obviously in the red. For the nine months ending November last year, the company lost just over $100,000.

And cash on hand lets just say theyre a bit light with $276. Thats enough to keep the lights on for a week or so.

Im not quite sure how this company will succeed with those numbers, but one things for sure even a pump and dump cant save BFLX. Stay far, far away from this stock.

VGTel (VGTL)

Just yesterday, over $62,700 was spent to pump shares of VGTL. Some of the big boys in the pump and dump game were quite busy RDI and all of their pumper outlets, and also the group of Blue Wave Advisors stock touting services.

The pumpers have been hyping VGTel for over a week now. And shares have been bouncing between $0.38 and $0.74. Regardless of the praise the pumpers are singing, Im going to give you the dirt on VGTL.

First off, we have an extremely unfocused company on our hands

VGTL started out known as Tribeka Tek, Inc. Management ran the company from 02/02-01/06 during which they provided Edgarizing services for publicly traded companies. Ok, fair enough.

But then, the company switched focus and bought technology to compete in the voice over IP (VOIP) business. VGTel systems ran this way from 01/06-02/11.

And after a series of failed share purchase agreements, VGTL ended up as a true shell company. Meaning theyre actively searching for a new business to run.

Fast forward to current affairs

VGTL is now a digital media firm actively pursuing the online distribution of digital entertainment products. And theyre doing business as 360 Entertainment & Productions.

Ok, so let me recap.

Theyve been a financial service provider to corporations, a player in VOIP, a shell company, and now an entertainment company. Can we get these guys a clown nose and shoes next?

With such a crazy past, their financials are equally as frazzled

Looking at their balance sheet, VGTel has $2,690. Wow, thats impressive. And that represents their total assets. Even better, VGTL has $834,510 in current liabilities. That math certainly doesnt equal out to the plus side.

With $0 revenue and a $1.7 million loss last year its going to take a whole lot to save this company!

Their stated goals for 2012 are to design and build a website, and find businesses and assets to acquire. I can tell you, they wont get very far with $2,690!

Steer clear of VGTL shares, no matter what the pumpers say!

A final word (and warning).

So that takes care of a few of this weeks inglorious pump and dumps.

Remember, theres a lot more of this going on each week than we highlight here.

As you know, penny stocks are a great place to invest your money. You just have to do your due diligence to stay away from all the scams out there these days!

Until next time,

Brian Walker

Category: Pump & Dump Alerts