Penny Stock Research Mailbag – NVAX

On Fridays we publish the extremely popular Pump And Dump Alert, which identifies penny stocks that are being pumped by penny stock promoters. Our goal is to expose potentially “bogus” promotions happening in the penny stock universe.

On Fridays we publish the extremely popular Pump And Dump Alert, which identifies penny stocks that are being pumped by penny stock promoters. Our goal is to expose potentially “bogus” promotions happening in the penny stock universe.

By bringing these to light, we help our readers avoid getting taken out to the woodshed.

Now, since we started publishing the Pump And Dump Alert nearly four years ago, it has become a huge hit with our readers. In fact, we receive email almost every day asking for our opinions on various penny stocks.

Unfortunately, we just don’t have the resources to personally respond to every email.

To remedy this problem, we frequently publish the Penny Stock Research Mailbag to answer readers’ questions about penny stocks. So, if there’s a penny stock you’d like our opinion on, just shoot us an email at customerservice@pennystockpublishing.com.

Also, we’d appreciate any feedback you can give us about Penny Stock Research and my investment advisory, Penny Stock All-Stars.

Let us know what you really think about the websites and the content we provide. And if you’ve made money or avoided losses based on our research, analysis, or recommendations, we’d love to hear those stories too.

By the way, those of you who provide feedback and/or testimonials about Penny Stock Research or Penny Stock All-Stars will be more likely to have your questions answered here!

A Penny Stock Many Readers Are Asking About

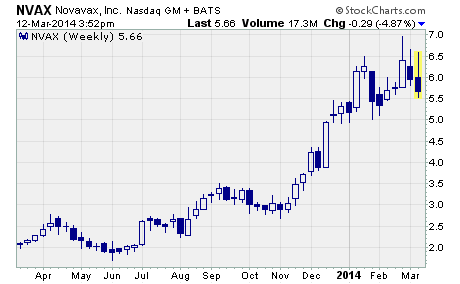

Novavax (NASDAQ: NVAX)

One penny stock that many of our readers are asking about right now is NVAX. While the stock has been promoted by a few penny stock newsletters, it is most definitely not a pump and dump penny stock.

Novavax is a clinical stage biotech that focuses on developing recombinant protein nanoparticle vaccines. The company’s vaccine candidates target seasonal influenza, pandemic (H5N1) influenza, and respiratory syncytial virus (RSV).

While NVAX is not the subject of any pump and dump campaigns currently, it is still a speculative stock.

Take a look at its financials for 2013 if you don’t believe me.

First off, the company does not have any approved drugs on the market so it derives revenue solely by performing research and development (R&D) for the government. And last year, revenues declined 5% to $20.9 million due to less activity on the clinical trials associated with its government contracts.

Second, the company spends a lot of money on R&D to move its vaccine candidates through clinical testing. Last year, NVAX spent over $50 million on research and development which was 87% more than in 2012.

The higher R&D costs in 2013 led to an 82% rise in net loss to nearly $52 million. And that worked out to a 41% increase in net loss per share, which came in at ($0.31) per share.

As you can see, NVAX does not have blue-chip like fundamentals. Revenues and earnings are not growing every year at a consistent rate.

At least, not yet…

But that doesn’t make the stock a bad investment necessarily. It just means the stock is speculative. That means it’s only appropriate if you have a high tolerance for risk and can afford to lose your investment.

With that said, speculative biotechs can grow into full-fledged pharmaceutical companies. And investors who buy shares in the early years can make huge returns on their money.

Take a look at long-term stock chart for Amgen (NASDAQ: AMGN), Gilead Sciences (NASDAQ: GILD), and Biogen (NASDAQ: BIIB) if you need convincing.

What’s more, biotechs can provide great returns even while they’re still in the clinical development stage. These stocks tend to be very volatile with broad price swings. But they will often rally around major events like the release of clinical trial results or an FDA decision.

And if the results are good or the FDA approves a drug, you’ll often see the biotech’s stock price skyrocket.

NVAX is going through this clinical testing stage right now.

The company has three vaccine candidates in mid-stage testing that are targeting widespread infectious diseases. Each one of these vaccines, if ultimately approved by the FDA, has potential to generate hundreds of millions if not billions of dollars for Novavax.

And 2014 is shaping up to be an important year for Novavax.

After raising $87 million through a public offering in September, the company’s sitting on over $130 million in cash. What’s more, Novavax is poised to earn $40 to $50 million on its government contract with the US Department of Health and Human Services this year.

In other words, the company has plenty of money to fund its operations and clinical programs for at least the next two years.

But perhaps the most exciting thing is that Novavax is expected to release important trial results by mid-year for each of its mid-stage vaccine candidates.

With important trial results on the horizon, NVAX is likely to trend higher going into the announcements. And if the results are good, the stock could really soar on the news.

However, if the results are bad, the stock could really tank. It’s not uncommon to see a high-flying biotech lose half its value or more in a single day on bad results.

I think NVAX is an exciting biotech stock with big upside potential. But you must be comfortable with the high risk involved if you’re going to trade it.

Profitably Yours,

Robert Morris

Category: Penny Stock Tips