Penny Stock Research Mailbag – Pan Global (PGLO)

Investing in penny stocks can be a great way to make gobs of money in the market. But it isn’t an easy thing to do. There are thousands of penny stocks out there to choose from.

Investing in penny stocks can be a great way to make gobs of money in the market. But it isn’t an easy thing to do. There are thousands of penny stocks out there to choose from.

And separating the legitimate penny stocks from the growing number of penny stock scams is tedious, painstaking work.

The good news is… we’re here to help.

Every Friday we publish a “Pump And Dump Alert” that identifies penny stocks being pumped by penny stock promoters. The purpose of the article is to expose potentially “bogus” promotions happening in the penny stock universe.

By bringing these to light, we help our readers avoid getting taken out to the woodshed.

Now, since we started publishing the Pump And Dump Alert three years ago, it has become a huge hit with readers. And as a result, they’ve become more attuned to sniffing out potential penny stock pump and dumps.

In fact, we receive a large number of emails every day from readers asking for our opinions on various penny stocks. Unfortunately, we just don’t have the resources to personally respond to every email.

So we’re going to start answering those questions here. If there’s a penny stock you’d like our opinion on, just shoot us an email at customerservice@pennystockpublishing.com.

Also, we’d appreciate any feedback you can give us about Penny Stock Research. Let us know what you really think about the site and the content we provide. And if you’ve made money or avoided losses based on our research, analysis, or recommendations, we’d love to hear those stories too.

One penny stock that we’ve received a lot of questions about is Pan Global (OTCQB: PGLO).

Let’s take a closer look at it now…

I did some digging and found that Pan Global is indeed the subject of an ongoing promotion campaign. At least five penny stock newsletters were paid over $1.1 million to hype the stock.

It’s one of the most highly financed promotional campaigns we’ve ever seen.

And it appears to have achieved the desired effect not once but twice…

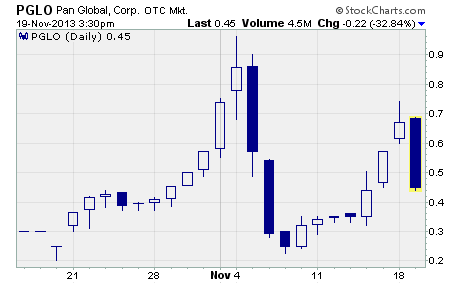

As you can see, the stock climbed from a low of 20 cents on October 18th to a high of 96 cents on November 4th. The move produced a stunning 380% gain in just over two weeks time.

You have to believe there were some very happy insiders at Pan Global.

But then the dumpers took over.

They unloaded shares of PGLO at a rapid pace over the next three days. As a result, the stock plunged to a low of 22.5 cents and lost more than 76% of its value.

Nevertheless, the promotional emails kept coming…

And thanks to the promises of huge returns, investors began buying the stock once again. In fact, PGLO embarked on a new uptrend which carried the stock to a high of 74 cents on Monday.

But the rally now appears to have run its course.

The dumpers were out in full force on Tuesday. More than 4 million shares of PGLO traded hands yesterday. And the stock shed more than 30% of its value.

No question about it, the promotional campaign has created enormous volatility in a penny stock that had been lying dormant for months.

The real question though is whether Pan Global is a worthy investment?

We certainly don’t think so…

You see, Pan Global is nothing more than a development stage company. It currently does not operate any business of its own. By its own admission, the company is merely attempting to get into the green energy game through acquisitions.

According to several press releases that accompanied the promotion campaign, Pan Global’s subsidiary, Pan Asia Infratech, has a “definitive agreement” to purchase a small hydroelectric power plant in India. Pan Global is still conducting its due diligence, but management appears optimistic the deal will go through.

Now, Pan Global makes a big deal in its press releases about how this industry will be worth $38 billion by 2015. But it doesn’t provide any guidance about what kind of revenue and profit its small hydroelectric power plant (assuming the purchase goes through) will generate.

All we know, based on information from Pan Global, is that the plant will generate 5.7 megawatts of hydroelectric power when its complete. Assuming that’s true, the plant will account for just a minute portion of the global installed hydroelectric power base of around 98 gigawatts (per market research by Global Data).

It certainly doesn’t seem likely that this one small plant will generate much revenue let alone a profit for Pan Global.

In our humble opinion, Pan Global is trying to attract investors by promoting the industry’s revenue potential while providing few facts about the company’s true money making potential.

Another thing we know about Pan global is that it’s in shaky financial shape…

According to the most recent quarterly report, the company has just $9,822 in cash and total assets of $20,322. That compares with total liabilities of $394,662 and a total stockholder deficit of $374,340.

As the company itself admits, the future of Pan Global “is dependent upon its ability to obtain financing” and this condition raises “substantial doubt about the Company’s ability to continue as a going concern.”

Clearly, it’s hard to see how the company’s $232 million market cap is justified. The company has a flimsy balance sheet and has not produced any revenue from the operation of a business.

The only revenue it claims over the past nine months was about $15,000 generated from the exchange of stock between Pan Global and Pan Asia Infratech.

Whenever we see a million dollar promotion campaign for the penny stock of a development stage company, we immediately become suspicious. And given Pan Global’s weak financial condition and the absence of any successful operating history, we believe there’s enough smoke here to justify our concerns.

So, what should investors do?

We recommend you avoid gambling your hard earned money on PGLO until the company shows it can deliver on some of its bold promises. If you already own the stock, we suggest you lock in your gains as soon as possible.

Profitably Yours,

Robert Morris

Category: Penny Stock Tips, Pump & Dump Alerts